Diminishing depreciation method formula

This method is a mix of straight line and diminishing balance method. If you started to hold the asset before 10 May 2006 the formula for the diminishing value method is.

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Diminishing Balance Method of Depreciation also called as reducing balance method where assets depreciate at a higher rate in the initial years than in the subsequent years.

. Recognised by income tax. Depreciation Rate Book Value Salvage Value x Depreciation Rate The diminishing balance method of. Year 1 2000 x 20 400 Year 2 2000 400 1600 x.

One such method of depreciation is. Cost value 10000 DV rate 30 3000. Thus depreciation is charged on the reduced value of the fixed asset in the beginning of the year.

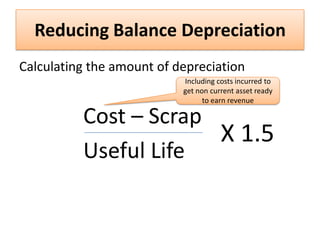

2000 - 500 x 30 percent 450. If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this. Depreciation amount book value rate of depreciation100.

This formula is derived from the study of the behavior of the assets over a period of time. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. Some of the merits of diminishing balance method are as follows.

Solution The solution is given below Total cost cost of machinery transportation installation 1500000 175000 75000 Rs. The various methods of depreciation are based on a formula. So Total Cost of an asset 110000015000050000 Rs 1300000- The following table shows the year by year.

1750000- Depreciation rate 12. In this lesson we explain what the straight line and diminishing balance depreciation methods are show the formula for calculating the depreciation methods. Diminishing Balance Method Example.

Base value days held 365 150 assets effective life Reduction for non-taxable use. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years. In this video we use the diminishing value method to calculate depreciation.

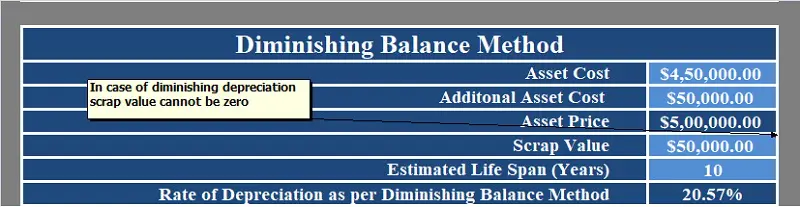

Formula to Calculate Depreciation Value via Diminishing Balance Method The formula for determining depreciation value using the declining balance method is-. And the residual value is. Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset.

The rate of Depreciation 10 Year ending 31 March. You might need this in your mathematics class when youre looking at geometric s. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows.

Under the straight-line depreciation method the company would deduct 2700 per year for 10 yearsthat is 30000 minus 3000 divided by 10. The formula for the diminishing balance method of depreciation is. Diminishing balance or Written down value or Reducing balance Method.

Double Declining Balance Depreciation Calculator

Depreciation All Concepts Explained Oyetechy

Solved I M Trying To Calculate For The Diminishing Rate On Chegg Com

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Diminishing Value Method Youtube

Written Down Value Method Of Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

Written Down Value Method Of Depreciation Calculation

Reducing Balance Depreciation What Is Reducing Balance Depreciation

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

Depreciation Diminishing Balance Method Youtube

Straight Line Vs Reducing Balance Depreciation Youtube

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro

Reducing Balance Method For Depreciation