26+ heloc vs reverse mortgage

However reverse mortgage rates are fixed and. 5 Best HELOC Loans Compared Reviewed.

Pros And Cons Reverse Mortgage Line Of Credit Vs Home Equity Line Of Credit Federated Lending Corporationfederated Lending Corporation

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

. Leverage the Equity of Your Home with the Help of Discover. Also Get Your Funds Upfront. Web This type of reverse mortgage is designed for homeowners who.

Ad Call to find out more. Web Home equity loans also known as second mortgages are loans against the equity in your home. You make payments monthly over a set time period typically.

Top Lenders Reviewed By Industry Experts. Get More Out Of Your Home Equity Line Of Credit. Leverage the Equity of Your Home with the Help of Discover.

Apply Online Get Pre Approved In 24hrs. Compare Top Home Equity Loans Save Today. However theres one key difference.

Home equity is the. Web HELOC stands for home equity line of credit. Also Get Your Funds Upfront.

Web A home equity line of credit or HELOC is a revolving line of credit that allows you to borrow against the equity youve accrued in your home. Todays 10 Best HELOC Loan Rates. Web -00032 -026 USDJPY.

HELOC is easier when you have a feel for how each one. Ad Opt for Fixed Rates and Monthly Payments Instead of a HELOC. First its a line of credit.

Why Not Borrow from Yourself. Web A reverse mortgage is similar to a HELOC as it allows you to get your home equity as borrowed money. Ad Reviews Trusted by 45000000.

Ad Trusted Way To Calculate Your House Payment In 3 Mins. Web A reverse mortgage home equity loan or home equity line of credit HELOC could provide the cash you need for living expenses home improvements and. Skip The Bank Save.

Web A reverse mortgage is a good option for older borrowers who want to supplement their retirement income. Apply Get Fast Pre Approval. By selling your home you will unlock 100 of your equity.

You may not walk away from the transaction with the full amount. Apply for a Home Loan Today. Home equity loan vs.

Ad While there are numerous benefits to the product there are some drawbacks. Put Your Home Equity To Work Pay For Big Expenses. Are 62 years of age or older Own and live in an eligible property type such as a single-family.

Web A reverse mortgage provides you with either a lump sum or regular cash payments worth up to 55 of the market value of your home and charges monthly. Costs 0 To See Savings. While it has similarities to a home equity loan a HELOC has a couple of key differences.

Mortgages are used by prospective buyers to fund the purchase. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. Web Mortgages and home equity loans are both forms of borrowing that use your home as collateral.

Web When it comes to interest rates of a HELOC vs reverse mortgage HELOC rates are typically between 2-3 lower. Ad Find The Best HELOC Rates. Home equity loans have the fewest restrictions but.

Ad Opt for Fixed Rates and Monthly Payments Instead of a HELOC. Apply for a Home Loan Today. Comparing a reverse mortgage vs.

Heloc Vs Reverse Mortgage Pros And Cons Rates Regulation Kevin A Guttman

:max_bytes(150000):strip_icc()/GettyImages-1128929333-ea8d9224211341d8b3ce228884ebf20e.jpg)

Reverse Mortgage Vs Home Equity Loan Which Is Better

Reverse Mortgage Intercap Lending

Reverse Mortgage Vs Heloc Home Equity Loans Goodlife

Reverse Mortgage Vs Heloc Vs Home Equity Loan

Reverse Mortgage Or Heloc Which Is Best

What Is A Reverse Mortgage Z Reverse Mortgage Visual Ly

:max_bytes(150000):strip_icc()/GettyImages-591408681-66cf602b3a9d48598f2e030b0d7052ff.jpg)

Reverse Mortgage Vs Home Equity Loan Which Is Better

Legal Notices Issuu

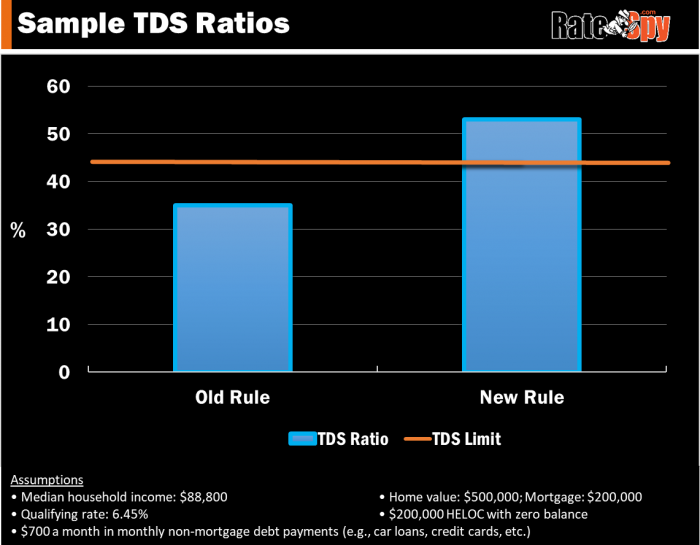

Got A Heloc Your Mortgage Options Are About To Shrink Ratespy Com

Home Equity Loan Or Heloc Vs Reverse Mortgage How To Choose Credible

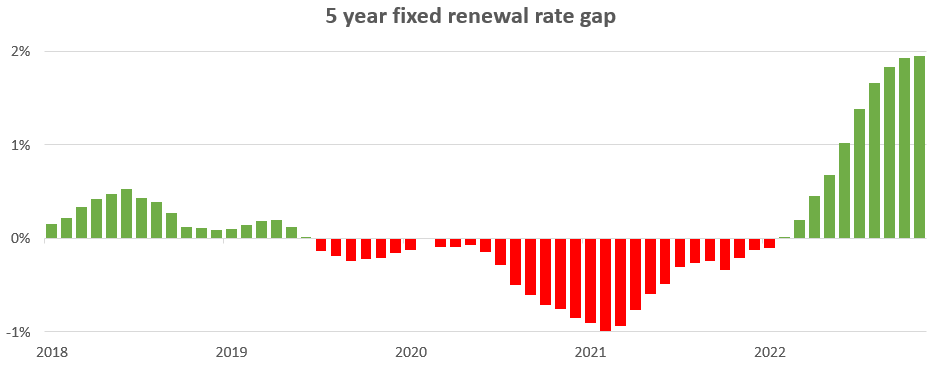

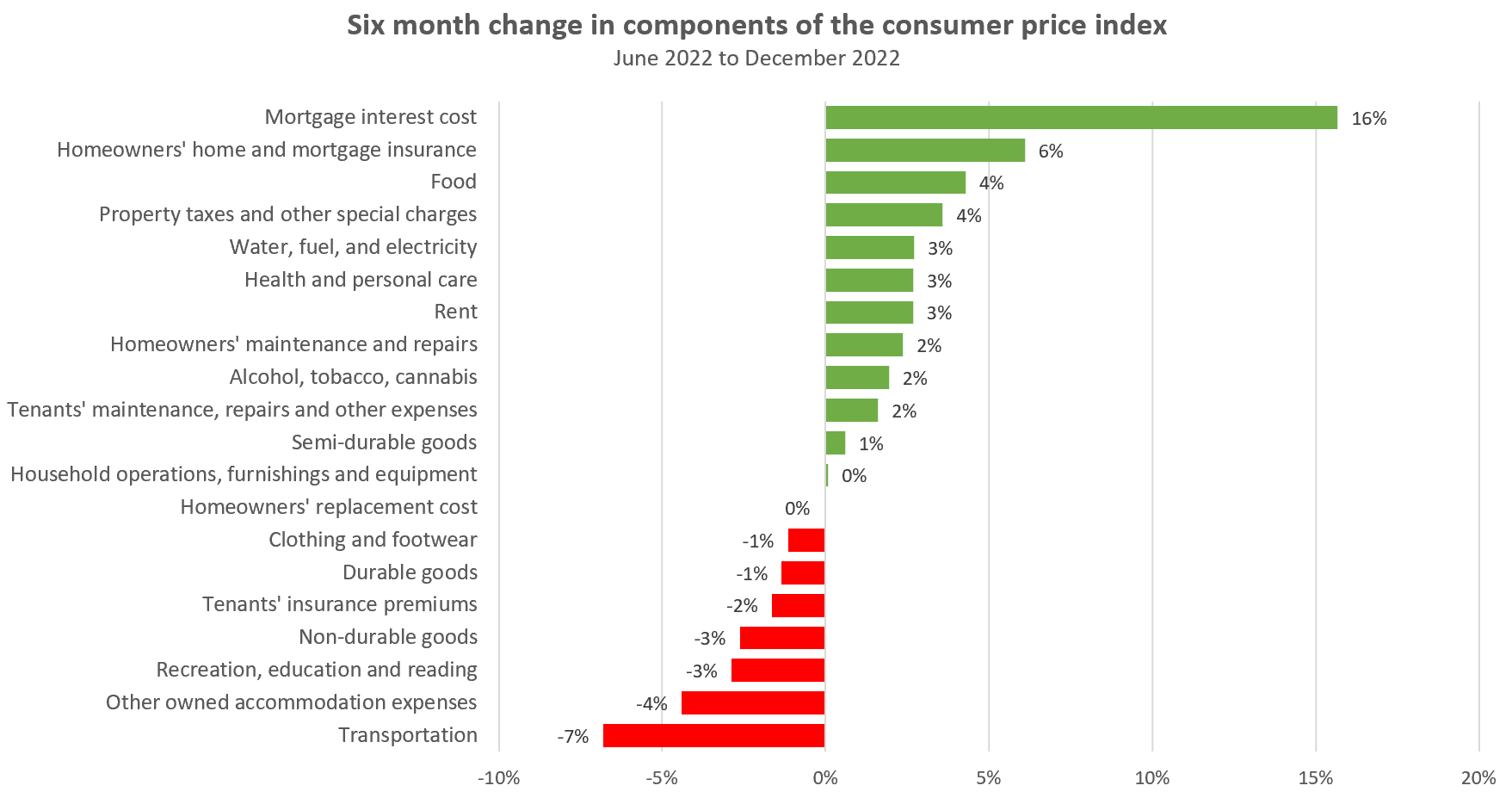

Changing Rates And The Market House Hunt Victoria

Changing Rates And The Market House Hunt Victoria

Heloc Or Home Equity Loan Vs Reverse Mortgage Bankrate

Heloc Vs Mortgage Everything You Need To Know Canadian Mortgages Inc

The Malibu Times February 2 2023 By 13 Stars Media Issuu

Changing Rates And The Market House Hunt Victoria